Top 15 Best P2P Lending Software Alternatives in 2022

P2P Lending Software is a real-estate debt financing software solution that uses features to help you manage and automate your loan operations while also improving team cooperation. This software provides you with clever tools that you may use to connect creatively and engagingly with your borrowers and other partners. It provides you with a login option that allows you to be active or live across all platforms or devices and communicate with others conveniently. Another fantastic benefit of this software is that you can use its advanced-level management tools to smoothly reduce the workload of large spreadsheets.

Top 15 Best P2P Lending Software Alternatives in 2022

Top 15 best P2p leading software alternative are explained here.

It has a credit score feature that you may use with a third party and calculate the results with its calculator. Furthermore, you may quickly onboard and hire investors and borrowers, allowing your company to grow in size. As a result, P2P Lending Software is an excellent choice in its area, and you can quickly integrate its features into your existing systems.

Alternatives to P2P Lending Software

1. DocMagic

DocMagic is a web-based platform that allows you to digitalize your mortgage and payment process by providing you with simple tools. It enables you to link all parties or stakeholders involved in the loan process, such as lenders, investors, borrowers, settlement service providers, attorneys, and so on, in order to speed up the loan process. You can use this platform to create a variety of documents, and it ensures complete privacy for your documents from start to finish. Another excellent aspect of this platform is that it provides a secure and secured environment in which to accept e-signature and better handle papers. Also check Best voice changer software

It enables you to become a paperless organisation while also lowering operational costs. Furthermore, it enables you to carry out all operations in full conformity with all applicable laws and regulations. It comes with a mobile app that allows users to easily share documents. As a result, DocMagic is the most comprehensive solution in its category, covering all areas of the mortgage closing process.

2. Qualia

Qualia is a comprehensive and all-in-one mortgage closing, buying, and selling platform that allows you to digitise these manual procedures and increase their speed and quality. It assists you in reducing your workload and automating your activities. You can use its marketplace to learn more about the different sellers and how they operate. It provides comprehensive reports that you may use to examine your bookkeeping and manage your business. From any location, this platform enables you to give a complete closure experience.

FedEx, BankUnited, SLK, simple, data-trace, Stewart, and many other integrations are included to make your work easier, faster, and streamlined. You may also personalise its dashboard, which is large and extensive and gives you access to all of the features. As a result, Qualia is the finest option due to its features and tools that help you improve your processes.

3. MBS Highway

MBS Highway is a nice web-based loan or mortgage management software system that connects all parties and stakeholders while speeding up the process. It provides you with coaching and learning materials to help you compete with your peers. You can use its financial calculator, which is incredibly user-friendly and automatically performs rapid calculations. It provides you with comprehensive real estate statistics as well as historical data.

You can use it to generate predicted rates and create a detailed timetable. It also includes a loan expert who will guide you through every stage of the process. As a result, MBS Highway is an excellent choice for streamlining procedures, with features like as open house flyers, social studio, exhibition expressway, integrations, and more.

4. Bryt

Bryt is a clever and smart web-based platform that provides you with tools that allow you to send & receive money instantly from any location and assists people who do not have bank accounts to complete transactions. This platform is powered by blockchain technology, which allows you to send money around the world. It has a database of more than thirty foreign platforms and caters to the specific demands of consumers. With the help of this platform, you can speed up your process.

It comes with industry-standard security protocols that ensure that money is sent safely and securely. Furthermore, it collects all minimum fees and provides you with an app or website to do operations with ease. If you’re searching for a platform that allows you to send money to any destination fast and securely, this is an excellent choice.

5. The Mortgage Office

The Mortgage Office is a web-based loan servicing platform that helps you streamline your loan process and close loans rapidly. It provides you with a robust tool that you can easily integrate into your operations and use to manage any type of loan. This platform allows you to scan documents and do a variety of tasks with a single click. It enables you to manage your organisation more efficiently while also streamlining all of your documentation. You can quickly have access to its reports and communicate with your investors. It generates reports for you on a daily, weekly, and monthly basis.

It enables you to carry out the process while adhering to all local and federal regulations, and it allows you to readily audit your procedures. It also has expandable features that you can add to depending on the size of your company. You can obtain live assistance from industry professionals, as well as a full integration option. In a nutshell, The Mortgage Office assists you in digitising your process and increasing your production by completing operations swiftly.

6. SimpleNexus

SimpleNexus is a nice web-based platform that allows you to manage and handle your loan process while also assisting you in bringing all stakeholders into a single platform for a seamless transaction. It nourishes you with the tools you need to communicate with your borrowers and other real estate partners. You can use the company’s mobile tools to assist you increase the quality of your loan output. It has a single login option that allows you to stay active across all platforms and collaborate with others easily. The biggest aspect of this platform is that you can use its management features to eliminate manual labour and large spreadsheets. Also check promapp alternatives

It offers a broad and comprehensive dashboard that includes all areas of debt administration. It also covers loan originators, borrower experience, real estate partners, mortgage lenders, banks, credit unions, and independent mortgage banks, among other options. As a result, SimpleNexus is a straightforward and straightforward platform that streamlines your procedures.

7. LOAN SERVICING SOFT

LOAN SERVICING SOFT is a web based platform that helps you analyse a product before investing by allowing you to conduct the loan procedure from anywhere in the world. It enables you to consult with industry professionals and submit jobs for consulting with ease. This platform may be used to plan meetings with your consultants as well as site training at any location across the world. This platform’s finest benefit is that it allows you to eliminate spreadsheets and streamline all of your documents. It has a simple & user-friendly layout that allows you to quickly access all of the features.

It encourages you to link all of your partners and finalise transactions with a single click. Furthermore, you may streamline your accounting operations and conveniently set up your accounts. It enables you to develop your company’s CRM activities. As a result, LOAN SERVICING SOFT is the greatest option in its category, and its features may be readily customised.

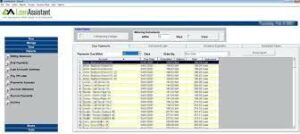

8. LoanAssistant

LoanAssistant is a web-based, all-in-one software solution that helps you to effectively manage various loans while also streamlining all of your credit lines. It includes a Quickbooks integration, which you may use to eliminate manual tasks. You can use its powerful reporting capabilities, which include tables, payment coupons, billing statements, pay-off statements, and account statements, all of which are very configurable. It has a basic and user-friendly interface, and you may use all of its capabilities.

It provides you with clever calculating tools that allow you to perform any calculation while adhering to all norms and regulations. You can also use a dashboard to follow loan activity and monitor all indicators in real time. As a result, LoanAssistant provides you with capabilities that are both flexible and easy to automate.

9.LendingWise

LendingWise is a web-based, intelligent software solution that allows you to automate your lending business and improve your organization’s CRM. It has a comprehensive dashboard that provides a detailed overview of all of your debts and readily forecasts future trends. You can use this software to automate all of your lending operations and to easily export your loans. It offers customisable loan arrangements as well as access to its marketplace for better possibilities.

It allows you to establish a portal that you can use to keep track of your team and collaborate with them more simply. Furthermore, you can generate reports to analyse your operations. It has a basic and user-friendly UI. You can enhance your revenue by automating your company process. As a result, LendingWise is a full software with a lending platform, website connection with online forms, industrial level security, and many other noteworthy features.

10. BNTouch Mortgage CRM

BNTouch Mortgage CRM is a cloud based platform that enables you to automate your marketing activities in order to convert more leads and make more money. It provides you with tools to engage with current borrowers in a fun and engaging way, as well as onboard a huge number of new and potential partners into your organisation. This software can be used for personal setup as well as enterprise-wide configuration. Its interface is straightforward and comprehensive, allowing you to conveniently monitor and track all loan characteristics. Also check DVD authoring software

It helps you to forecast future trends and manage your partners and browsers from a single interface. You can also utilise it to automate email operations and boost team cooperation. As a result, BNTouch Mortgage CRM is an excellent choice in its field, including survey, live chat, digital 1003 application, video-marketing, social media content, e-signature, and other noteworthy features.

11. LoanPro

LoanPro is a web-based loan management software that allows you to create a dynamic portfolio and automate your procedures in real time. It helps you collaborate with your investors by effortlessly simplifying difficult operations. You can manage your borrowers on a single page with this platform, and you can quickly configure its comprehensive dashboard. It provides a variety of consumer lending choices, including student loans, personal loans, home improvement loans, cryptocurrency loans, and medical loans, among others.

It authorises you to manage all of your accounting and financial activities from one place, as well as provide you with POS lending options such as POS financing, POS lease, and more. Title loans, car leases, prime auto loans, aid prime auto loans, SBA, credit limit, payroll advance, hard money, cash advance, instalment loans, payday loans, equipment leases, small business loans, and many other features make LoanPro an all-in-one software.

12. LendFoundry

LendFoundry is a cloud-based, all-in-one software solution that enables lending firms manage their operations and convert their manual work into digital space. It facilitates you to automate your processes and eliminate the need for massive spreadsheets and human labour. You can create documents such as invoices & purchase orders and send them directly to the recipient. This software meets the needs of indivial working for the entire organisation and includes a complete dashboard. You may quickly view the report’s analytical data and make your own decisions.

It enables you to manage your financial operations and conduct transactions with only a few mouse clicks. It also allows you to communicate with all of your stakeholders and access information from any location. In short, LendFoundry is an excellent choice in its field, providing services such as personal loans, lending, hard money, supply chain, point of sale, merchant capital, integrations, and more.

13. Visionet Loan

Visionet Loan is an awesome web-based loan processing platform that enables you manage your loan portfolio and connect all of your stakeholders in one place. It gives you access to a sophisticated and intelligent solution that you can quickly integrate with your systems and use to manage all types of loans. This platform allows you to scan and produce documents as well as complete a variety of transactions with a single click. It allows you to conveniently access reports and communicate with your investors or browsers.

It enables you to make informed decisions based on reports that are available on a daily, weekly, and monthly basis. Furthermore, you may effortlessly automate your loan or mortgage operations and acquire new investors from all around the world. In summary, Visionet Loan takes care of all areas of loan management and provides you with user-friendly features.

14. Elending Platform

Elending Platform is a nice loan management software that provides you with a variety of features and tools to help you run your loan operation more efficiently and recruit new investors to expand your business. It enables you to manage your quotes and close your loan in an efficient and timely manner. You may manage your investors, and the programme provides you with a detailed calendar that you can amend as needed. It has a customizable end-user portal that allows you to stay in touch with your clients.

It is a fully integrated software that provides a comprehensive solution for managing your business. Furthermore, you can manage several portfolios and access extensive and accurate information. As a result, Elending Platform is a good alternative in its category, with easily configurable features.

15. Ezbob

Ezbob is a lending platform that offers end-to-end digital lending solutions for SME, consumer, and asset financing lenders. With real-time authentication, smart onboarding provides a flexible, multichannel, and intuitive experience for your customers. The software offers a versatile alternative for your automated risk decision, allowing you to use numerous data sources to ensure that customers receive the best lending choice possible.

You can receive detailed information on your customers using the software, including their inputs, internal analysis, and external data sources. Customers can save time by signing loan documents digitally, and payments are processed quickly. To manage payments, run marketing campaigns, and assess the customer experience, Ezbob offers world-class business intelligence and CRM. A salesforce plug-in is also available, which allows you to create templates, alter outgoing communications, and set up time-based event triggers.