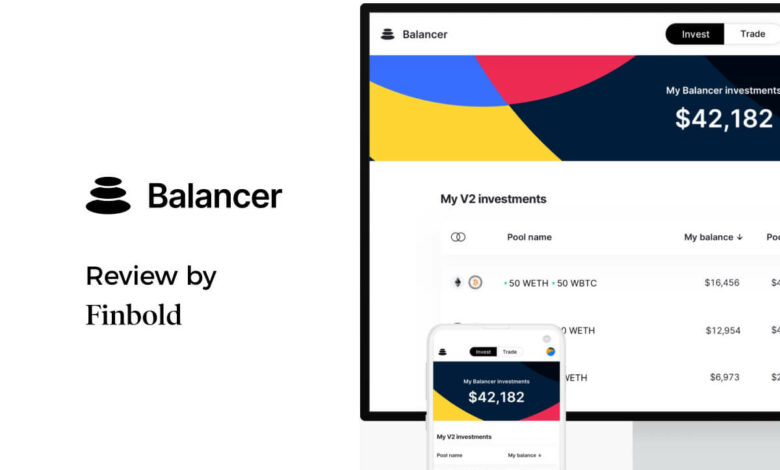

Balancer Review and Opinion 2024 Is it a scam?

Balancer Review and Opinion 2024 Is it a scam? Balancer is a DeFi-like protocol Automatic Market Maker, that is, it is an automatic decentralized market maker.

Balancer Review and Opinion 2024 Is it a scam?

In this article, you can know about Balancer Review and Opinion 2024 Is it a scam? here are the details below;

What is the objective?

Facilitate the exchange of cryptocurrencies by reducing costs and slippages, all thanks to its optimized liquidity provision.

How is this done?

If you want to start supporting in cryptocurrencies, we recommend that you start buying your first tokens on Coinbase. If you deposit 100 euros by registering on OUR LINK, you will earn an extra 10 euros!

Through the use of algorithms that efficiently allocate pool funds to each operation.

In other words, the basis of the operation of this platform is liquidity programming. Liquidity providers place their funds in the pools and Balancer’s algorithm offers these funds to anyone who needs to buy and sell a certain currency.

One thing that sets Balancer apart from other MMA(Automated Market Makers) is that it has no 50-50 cap on liquidity pools. The weight in this case can be variable, which gives more flexibility to the project. This means that in a more “traditional” DeFi project, the user must deposit at least 50% in Ethereum, while in Balancer it does not have to be so and if you wish, you can deposit 80 or 90% of all supported tokens..

- Therefore, this platform can be used as:

- Liquidity provider in pools (you become a market maker)

- Token trader (you use pool liquidity)

- Ecosystem for applying algorithmic trading techniques

Is the balancer safe? Is it regulated?

Well, as you already know or should know, the DeFi world is one of the newest in the world, and therefore its regulation is far from the traditional trading markets that we can find. This is another Balancer Review.

That is to say, Balancer is not regulated by the FCA, NFA or such bodies.

What I can find about this company is that it is a venture capital project based in Estonia that has been running since 2019 by Mike McDonald and Fernando Martinelli, after raising funds for $3 million from companies like Accomplice and Placeholder.

In principle, it seems like a safe business and there is no indication that it can be treated as an unreliable project. However, it is something that focuses on the medium term, so we will have to wait at least two years to see how the project performs.

On its own homepage they tell us that it’s a company in beta state and that we shouldn’t invest a lot of money, so that should be enough for now to know that it’s not the where we should put all our savings.

They also tell us that they perform rigorous audits to make sure their system is working properly. Remember that this is a digital project that can have many system failures, both in terms of operation and weakness in the face of hacker attacks.

Is Balancer a scam?

For the moment, it seems not. It looks like a serious project, and I sincerely believe that if it fails, it will be more due to its venture capital nature, as there is no guarantee that it will succeed in the market.

Maybe the idea will work and in a few years it will be a giant in the forex market or it can go wrong and the business will eventually close. This is another Balancer Review.

How do Balancer pools work?

Pools are liquidity pools. For there to be this liquidity, there must be users who have put their tokens or cryptos there. They are responsible for providing the asset that traders will request from the Exchange.

On the pools page, we can see the liquidity projects created on the platform. We have three:

Shared (comparitos): Liquidities can be added to these pools but they cannot be modified. Its parameters are fixed. They are designed for bulk retail volume

- Intelligent

- Private: in these, only the creator of the pool can add or withdraw liquidity from it

- Details of one of the private pools

- If we want to see what are the characteristics of each pool, we just have to click and it shows us the composition of said MMA portfolio. The typical compositions of these pools that we can see are:

- 50% WETH and 50% BTC

- 80% GNO and 20% WETH

- 67% BAL and 33% WETH

If we want to add liquidity, we click on one of them and we can enter the corresponding token, where they will give us the percentage of participation in said pool.

It is assumed that by participating in this plan, we are able to receive a return.

Un important detail is to see the swaps of each operation. We can do this if we click on the “swaps” button, next to “Balances”. On the screen that appears, we can see the operations of the tokens and how they generate fees or an exchange commission. This is another Balancer Review.

In fact, if we press the operation button, we go to the Etherscanpage, where they give us all the details, with the address of purchase and the address of sale with its corresponding hash.

As liquidity providers, we are interested in doing a lot of trades, because that way we will receive more swap fees.

BAL token

After the initial success of his Balancer launch, he was encouraged to create his own token, called BAL, thus being the governance token of this platform. In this way, users who have this token can participate in future developments of the project.

To have BAL is like being an investor in this project, with all that that implies, from participating in its profits to being involved in its management. With this, someone who has a significant amount of BAL tokens has a say in future implementations of new changes in commission structures, for example.

These BAL tokens are distributed to liquidity providers, either by creating pools or by adding funds to the project. In this way, both the benefit, the project and the users. This is called liquidity mining, where mining involves adding liquidity to the market.

When pools are created, these BALs are obtained by simply receiving the transaction fees, which will be provided in this token. The lower the commissions, the more BAL will be received, rewarding those who offer low trading costs in order to attract more participants to the system.

Initially, 100 million of these tokens were created, including 25 million for founders and other key players, and 75 million to distribute to new entrants.

What can be the return on this activity of adding liquidity?

Possible annual returns (APY) of different pools in Balancer

On the page http://pools.vision/ we can see the latest performance data for each pool on this platform. Keep in mind that the APY is an estimate of the expected annual return, but it does not take into account other factors such as risks or subsequent changes in conditions.

Spare scale

The exchange gives us the ability to trade cryptocurrencies or tokens. As simple as that.

Being a decentralized exchange gives us the ability to operate with reduced bureaucratic costs as there are no identity or location requirements etc. The only thing we will need is to connect an external wallet such as Dappradar and start exchanging the currencies we want with the ones we have.

What assets or tokens does it offer?

Among others, we have ETH, BAL, USDC. DAI, BTC, mUSD, MKR, PERP, YFI, wNXM, UMA, LINK, renBTC, BZRX, SRM, LEND, AAVE, UNI, DOUGH, COMP, RPL and many more.

Trading is similar to what can be found at uniswapEg.

Who uses this exchange?

Retail traders looking for better trading terms

Arbitrajistsas looking for inefficiencies between this and other exchanges, both centralized and DEX

Traders who need funding or liquidity in specific tokens

La commission payable will depend the liquidity available at any given time and the commission/swap structure in the pool’s liquidity system. That is why it is important for the platform that there is more and more liquidity, because in this way there is more competition, better possibilities to obtain better conditions for traders.

Our opinions on Balancer

Undoubtedly, we are facing another of the flagship projects of the DeFi world.

A project that threatens to torpedo the classic system of centralized market makers and the entire current financial ecosystem. This is another Balancer Review.

The idea is pretty good, with its added flexibility removing the 50% ETH cap of other similar DEXs.

From the point of view of these MMA or Market Makers, a system with many incentives is presented, but there is still work to be done and we have to wait to see how it evolves. We are still too early to assess opinions on the product itself.

As with almost all of these types of projects when they are still in an early stage, the risk of hacking is high, and Balancer is no stranger to this, having known some in 2020. That’s why I think it’s prudent to take every precaution when operating on a site like this or similar.

If we want to know how the project is going, we can follow the price of its BAl token or be connected to its community on Discord, where there are over 10 members, and growing.